Many of the attitudes and behaviours that have driven decision making for retail brands have been called into question by the pandemic, but there are other forces disrupting the consumer-brand relationship. At SLD, one that we think is critical is the rise of fake news and misinformation, especially on social platforms. We wanted to determine how consumers define what is real in a world where seeing is no longer believing.

We conducted a study among 2000 North American respondents to find out what information they trust, what they think is “fake,” and to gauge what gives them confidence in brands. In this report, we share our findings as well as strategic tactics that CPG brands can take to build trust in a post-truth world, and, if so, what are the key factors.

Prior to publishing our DeepReal reports for the retail, CPG, and banking industries, we published two articles on the trends that may impact consumer trust:

DeepReal Part 1: Gaining Trust in a Post-Truth World

DeepReal Part 2: The Blurring Line Between Fact and Fiction

HYPOTHESIS

We hypothesized that consumer trust and perception is being impacted not only by the pandemic, but by other trends such as fake news, working from home and social justice movements.

We explored emerging trends that are likely to impact the perception of reality, namely:

- Growing tolerance towards explicit bias, for example with the rise of white supremacy groups.

- The rise of anxiety and a corresponding need to self-medicate through various means, including video games and substance abuse.

- Overexposure to extreme imagery, including violence, graphic sexuality and “toxic” commentary on the internet from a young age.

- A rising desire for “authenticity” from consumers, which could be linked to everything from using “real” models to local initiatives.

- Predictive analytics that power the algorithms used by social media platforms and other emerging technologies

- The redefinition of communities, for example gaming communities which are almost exclusively online but very active, that has been accelerated by the pandemic.

ABOUT THE STUDY

Research was conducted during the week of January 2021 with 2,000 consumers in both the United States and Canada as part of an online study (the questionnaire is available in the appendix of the full-length report for your reference).

The sample of the survey reflects great diversity of participants through the U.S. and Canada and a comprehensive gender split. Age groups of respondents reflected a wide range of cohorts of the population.

RESEARCH GOALS

The study had the following objectives:

- To understand current and future customer definition of “real.”

- To determine which factors are impacting the perception of accuracy of information.

- Identify which marketing initiatives are seen as credible by consumers.

KEY TAKEAWAYS

The study shows that consumers are concerned regarding their ability to discern between real and false information, a concern they foresee growing in the future. Not surprisingly, a strong majority want to know whether or not something is factual. However, there are some interesting nuances to note.

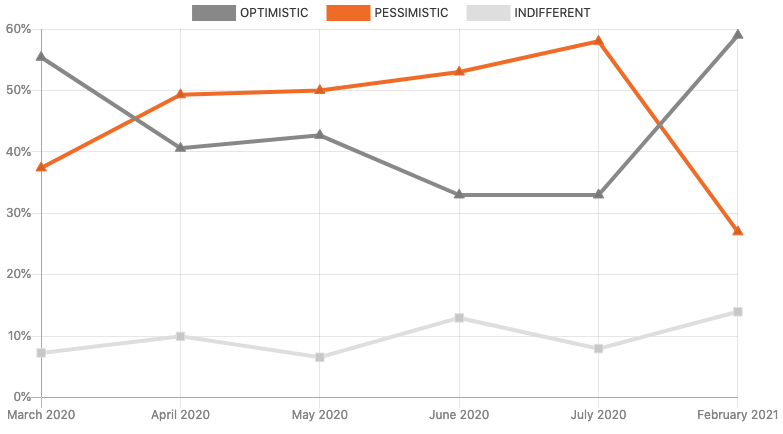

- In spite of a growing level of mistrust, consumers are more optimistic than they were in 2020.

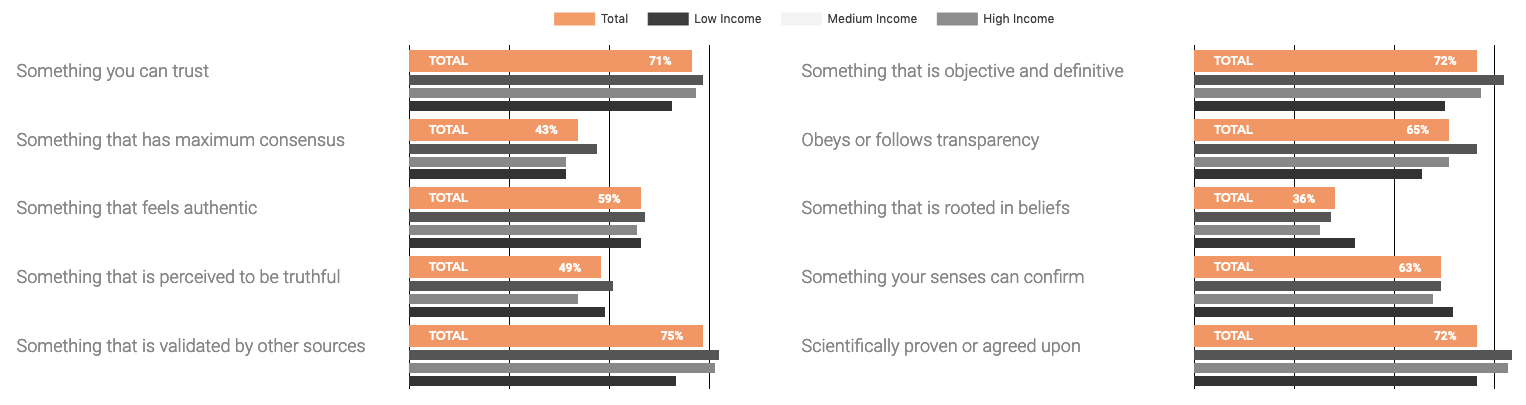

- Lower earners are less concerned with truth compared to high earners.

- Women value real more highly than men.

- The importance of realness rises with age.

In spite of a demonstrable concern over the veracity of information, consumers still report being open to new opinions. However, consumers who identified they were extremely open to new opinions rank the importance of being able to discern real information significantly higher, indicating the willingness to unique views is predicated on these being truthful.

Source: 2021 SLD DeepReal Study

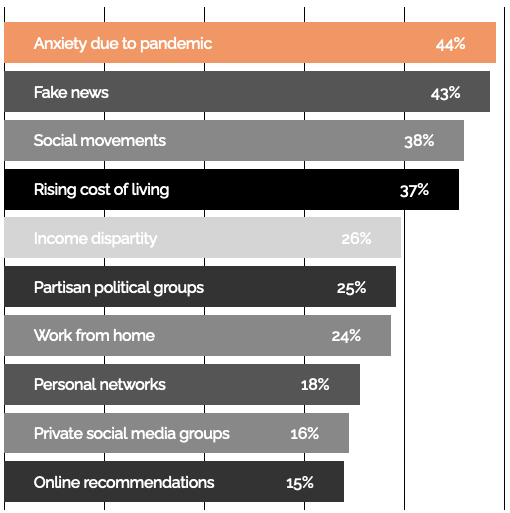

“Please indicate which of the following factors have changed your perception of an issue or idea in the last 12 months”

SHIFTS IN ATTITUDE

We know brands don’t exist in a bubble – everything that happens around us has an impact on how we feel and therefore, how we shop.

We wanted to find out what external factors have the most power over changing consumers’ ideas – unsurprisingly the pandemic was number one. But when we look at a ranked list of factors that consumers say have changed their mind about a subject, some interesting influences emerge.

Number two in the rankings was fake news, a fact also supported by a BrandTrust study by Edelman with 16,000 consumers, that showed 42 percent of US respondents and 36 percent globally listing it as an issue. Given the recent revelations about the impact of fake news on the U.S. Elections, awareness and concern on this subject is likely to keep growing.

Number three in our respondents’ ranking was social justice movements such as Black Lives Matter or Me Too. Income disparity and the rising cost of living follow in the ranks, suggesting that a sense of fairness is increasingly on the radar.

Consumers’ perception of current issues and ideas are also heavily influenced by work from home, a rise of personal networks and private social media groups. Factors that do not appear to have a strong influence are oriented towards entertainment (reality shows, gaming, inspirational videos), which suggests the consumer mindset is more focused on serious issues than popular culture or fun.

Source: 2021 SLD DeepReal Study

“Please indicate which of the following factors have changed your perception of an issue or idea in the last 12 months”

SHIFTS IN ATTITUDE

We know brands don’t exist in a bubble – everything that happens around us has an impact on how we feel and therefore, how we shop.

We wanted to find out what external factors have the most power over changing consumers’ ideas – unsurprisingly the pandemic was number one. But when we look at a ranked list of factors that consumers say have changed their mind about a subject, some interesting influences emerge.

Number two in the rankings was fake news, a fact also supported by a BrandTrust study by Edelman with 16,000 consumers, that showed 42 percent of US respondents and 36 percent globally listing it as an issue. Given the recent revelations about the impact of fake news on the U.S. Elections, awareness and concern on this subject is likely to keep growing.

Number three in our respondents’ ranking was social justice movements such as Black Lives Matter or Me Too. Income disparity and the rising cost of living follow in the ranks, suggesting that a sense of fairness is increasingly on the radar.

Consumers’ perception of current issues and ideas are also heavily influenced by work from home, a rise of personal networks and private social media groups. Factors that do not appear to have a strong influence are oriented towards entertainment (reality shows, gaming, inspirational videos), which suggests the consumer mindset is more focused on serious issues than popular culture or fun.

Source: 2021 SLD DeepReal Study

“Please indicate which of the following factors have changed your perception of an issue or idea in the last 12 months”

MEN AND WOMEN HAVE DIFFERENT VIEWS

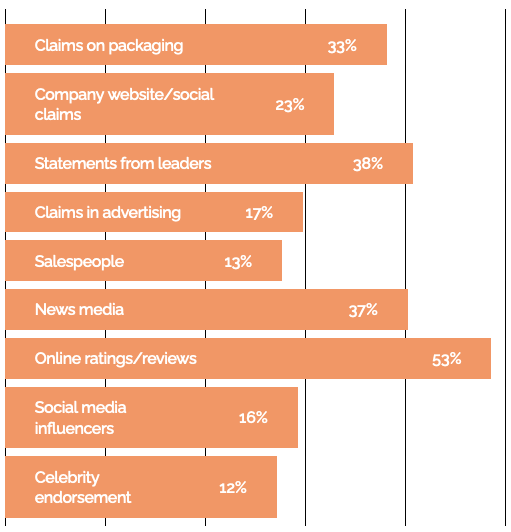

When we compared by gender, we noted that men ranked claims on packaging, claims on company websites and social media, salespeople, news media and social media influencers higher than women.

STRENGTHENING ON-PACK CLAIMS

Overall, the confidence in packaging claims was stronger than many other categories – and yet it is only trusted strongly by 33 percent of respondents. CPG brands need to clarify and validate claims through back panel story-telling, online and in social media campaigns. Third party verification plays an important role in building consumer confidence.

HIGH LEVEL INSIGHTS

COMMUNITY IS THE FOUNDATION OF TRUST

Our study indicates that financial institutions need to create a strong foundation supporting the community to build better brand loyalty. Only when retailers have established a strong community platform with their social marketing programs be seen as authentic.

REAL EQUALS FACT

Consumers are astute about accessing factual information through third party validation and information to determine the difference between real and fake. Financial institutions need to ensure a high degree of transparency in their offering while supporting any claim or promotional offering with validated facts.

REINFORCE OPTIMISM

Consumers are emerging from a period of high anxiety and pessimism in 2020. Marketing strategies need to celebrate and support the positive aspects of consumer’s lives while reducing any anxiety in the customer experience.

SUPPORT ONLINE REVIEWS TO OVERCOME SKEPTICISM

Consumers are looking for peer reviews online. Banks need to make better use of online platforms to enable this trusted source of information, for example, by allowing reviews of financial advisors.

ADVICE DRIVEN MODEL

The high cost of living and income disparity are in the top five issues that are changing consumers’ perspective. Better, more consumer-focused advice driven models should be a focus for banks.

INTERNAL COMMUNICATION NEEDS SOME ATTENTION

Interestingly, respondents indicated they are less confident about information they receive from their employer. Financial institutions need to rethink their internal communication to build trust in key messaging.

CONSUMER MINDSET

In order to understand what is driving perception, we have to understand what consumers feel. Needless to say 2020 was a bumpy emotional ride, and while vaccines and a new U.S. administration have lifted hopes, the turbulence is not over yet.

Throughout 2020, we conducted research on consumer attitudes, specifically tracking the level of optimism versus pessimism. There were many initiatives that boosted consumer confidence in retailers, such as supporting the local community and staff. These factors continue to be relevant and have a strong impact on consumer perception of truthfulness.

SHIFTS IN ATTITUDE

- Lower-income and younger consumers were the least optimistic.

- The findings reported an equal level of optimism between women versus men, which is a positive insight knowing women were 1.8 times more impacted by the pandemic versus men.

- We noticed a significant shift based on age, with 16 to 17 year olds significantly less optimistic than the total sample at 31 percent. This could be attributed to the inability to socialize and remote learning. Respondents became more optimistic as they got older, with the 35 to 54 age groups scoring higher than the total sample at 64 percent – 65 percent.

- Vulnerability pushed the oldest age segments down in the level of optimism.

- The higher income indexed significantly higher on their optimism level versus the lower-income consumers at 51 percent.

KEEPING AN OPEN MIND

Confidence may be getting a boost from a substantial sense of open mindedness to new ideas, which may be attributed to new things consumers adopted to manage life in lockdown. For many, it was the first time they did their banking or shopping online or tried cooking at home. Most interesting insights on the level of open-mindedness are:

- Women were more open to new opinions versus men.

- The 35-44 representing young families with children were the most receptive.

- It is exciting and somewhat startling that the 17-18 age group was the least open to new views.

- Lower income respondents are less open to new ideas, perhaps because they perceive they have fewer options

- children were the most receptive.

- It is exciting and somewhat startling that the 17-18 age group was the least open to new views.

CPG brands have felt this open minded attitude as supply chains were strained and consumers were more willing to try alternative brands. For some, this created an opportunity. Brands have a unique, timely opportunity to mirror consumer optimism through special offerings as a way to test new products, as well as through marketing content. It’s also a great time for CPG brands to explore direct-to-consumer platforms, as the openness to this has expanded greatly.

Our 2020 CPG COVID study also indicated consumers were open to exploring new brands, from indie offerings to private label alternatives. National brands have an opportunity to reclaim customer’s intent to purchase through leveraging online reviews and supporting social causes.

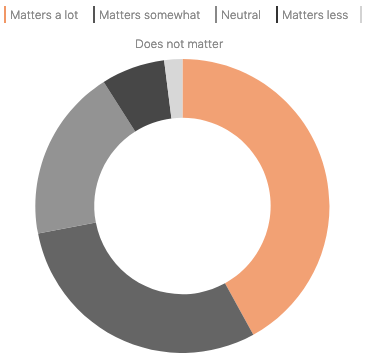

BEING TRUTHFUL MATTERS A LOT

The study’s core interest was to understand the importance and factors driving what defines real versus fake within consumers’ lives. Not surprisingly, a significant percentage of consumers indicate that knowing whether or not something is factual matters a lot.

As previously noted, women rated that “real” matters more than men, and the older you get the more it matters. Consumers who are very open to new ideas also rate truthfulness as much more important. Remarkably, 9 percent of consumers do not care if information is accurate, while 19 percent are neutral. This may seem shocking, but it also explains why so many are vulnerable to fake news and false claims. It may also be a naïve response, as those not negatively impacted by false information (yet) may rate it as less important. But long term, strategies to build trust are critical for survival for CPG brands. The recent backlash in the U.K, around brands such as Tesco’s “Farm Stores” and Sainsbury’s J. James private label programs due to their misleading “fake farms” messaging are examples of brands have opted for marketing that leverages a trend at the cost of being truthful.

Source: 2021 SLD DeepReal Study

“Does finding out or knowing something

is not necessarily real matter?”

HOW REAL IS BEING DEFINED

WHAT IS "REAL" ANYWAY?

We can look up a dictionary definition to see what “real” means, but we wanted to find out what it means to consumers, and even more importantly, how they are making the distinction between real and unreal.

According to respondents, reliable information is critical, such as scientifically proven data, or information that is validated by objective third parties or outside sources. It is interesting that although respondents are looking for facts, they also depend on their senses and intuition to define the truth. So, although most people define real by proven attributes, a significant percentage remains influenced by personal beliefs, a “gut” response or by deep-rooted biases.

These heuristic decisions we have learned over the years are based on the blink factor, the impulsive decisions consumers make when confronted with a complexity of information or choices.

WHERE DO CONSUMERS GO TO GET RELIABLE INFORMATION?

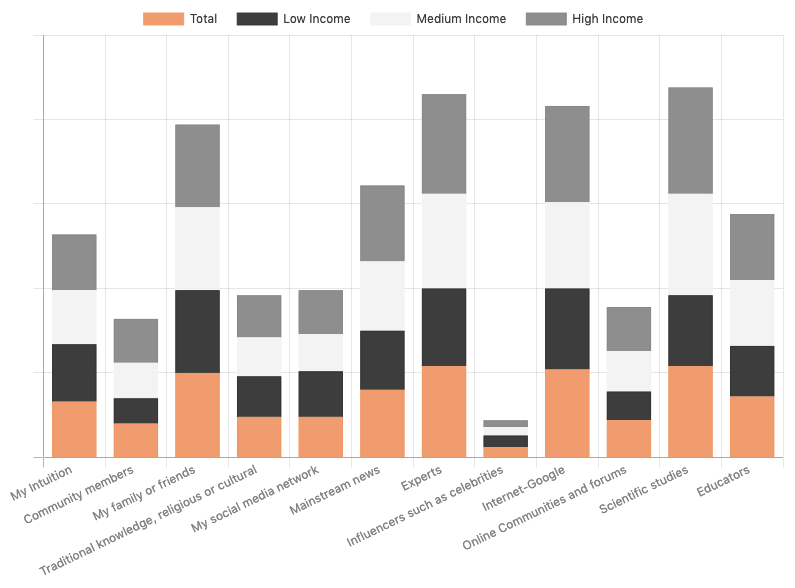

The top three sources respondents go to for trusted information are scientific studies, experts and the internet. Canadians scored “Internet-Google” much higher than Americans, but “maximum consensus” was considered the least reliable by all.

Fake news is a growing concern for a considerable percentage of consumers. Additionally, it’s essential to understand influencers’ and celebrity endorsement’s low credibility, which may undermine brands’ marketing strategies.

Lower-income consumers ranked the information they trust from family or friends the highest while middle and higher-income segments identify scientific studies as their top choice.

THE FACTORS DRIVING CONSUMER PERCEPTION OF REALITY

Stressful Factors Changing Perspectives

When we look at the factors that have shaped respondents’ perception in the last 12 months, the pandemic, the growth of fake news and social movements such as Black Lives Matter had the most significant impact. The other top factors were the rising cost of living, income disparity and work-from-home. Partisan political groups were also in the top ten.

What’s significant for brands to note is that in the top five factors that have influenced ideas, a number of them are linked strongly to notions of fairness (social movements, income inequality, rising cost of living). This correlates to the findings in our COVID-19 research, which indicated that how brands treat their employees and support communities was most important to consumers. Remember, these factors changed people’s perceptions. If Corporate Social Responsibility was important before the pandemic, it is now an absolute must.

Everyone’s a Skeptic

Although consumer confidence is high, the study identified the past year’s events have made people more skeptical. Consumers are acutely aware of factors such as the inability to verify sources, paid influencers or reviews, how easily misinformation can be passed off as legitimate, foreign interference and media bias. The greatest skeptics are:

- Americans are more skeptical their Canadian neighbours, which could be attributed to the recent controversial elections.

- Women are more skeptical than men except when it comes to government statements and Artificial Intelligence, which men are more skeptical of by a small margin.

- Mid to higher-income cohorts.

- Consumers who indicated they were open to new ideas are the most skeptical of all the information sources.

With consumers ranking news media as a highly trusted source, banks need to ensure a strong push for earned media. This could include financial columns, podcast appearances and promoting financial advisors as experts to news organizations for comment on various stories.

Low Confidence in Employers

A fascinating finding from the research was the dip in confidence consumers have about information they receive from their own employers. This lower level of trust (a full 10 percent dip) may result from the pandemic’s impact on employment. Women were less confident in their employers, and confidence levels did skew based on income levels with lower income consumers, who tended to be more trusting overall, less trusting of their employers.

Frontline financial workers are often undervalued and coming out of the pandemic, morale is low. If banks do not place employee engagement at the top of the priority list they may struggle to be able to deliver the kind of service excellence that will become a key differentiator for consumers. On the right hand side, here are some key ways banks can create a better place to work.

Getting to Real Through the Gut

Consumers did demonstrate strong skills in being able to define facts logically, but intuition and conventional wisdom play a significant role as well. Although instinct ranked seventh overall on how consumers determine what is real (even that is a surprising fact), when the information source is unknown, consumers ranked instinct second.

Most of us do rely on mental shortcuts to make decisions. Behavioural Economists refer to these as heuristics. It is much less time consuming to make a gut decision than it is to fact-check every source of information, especially given the amount of data we come across in our daily lives.

Banks need to provide truthful and transparent information, but they also need to give strong cues that align to instinctual responses to help guide the consumer.

A word of caution: relying only on cues and not being transparent will get you into hot water – although most of us don’t have time to dig around for every little fact, there are some who do. Consumers will call brands out for misrepresenting intentions with no action to back them up.

Low Trust Level in Marketing

As noted earlier, consumers perceive online reviews and ratings to be the most trustworthy source of information – however that trust dips for the retail sector. In spite of a noted concern about media bias, they do trust the news more than they trust ads, salespeople, influencers and celebrity endorsements. Brands need to pay close attention to these concerns.

Consumers may be less aware of how brands incentivize reviews online today – but if we take influencers as a case study example, we can see how this trust could be eroded. Influencers were a hot ticket to authenticity only a few short years ago – and yet our study demonstrates that influencers are now one of the least trusted sources of information, with only 16 percent of respondents trusting them. How did that happen?

At first, influencers were seen to be providing an unbiased third-party view. Brands took advantage of this. Then consumers discovered influencers were in fact being paid for these reviews – which came as a surprise to many. The trust in these kinds of endorsements has been tainted – online reviews could suffer the same fate.

Interestingly, men are overall more trusting of brand sources of information than women, rating claims on packaging, company websites, social media, salespeople and influencers higher than female respondents. Respondents who are open to new opinions are also more trustworthy, but they place their confidence in online reviews, news and industry leaders, while ranking influencers, celebrities and salespeople at the bottom.

WHICH INDUSTRY IS SEEN AS THE MOST AUTHENTIC?

Our COVID-19 studies demonstrated that consumers had a high degree of respect for supermarkets and drugstore chains in their response to the pandemic. These attitudes are reflected in this current study, where supermarkets and drugstores were ranked most authentic by respondents. Drugstores versus supermarkets shift based on age group, but both remained strong across all cohorts.

When it comes to authenticity, there are some significant gaps in consumers’ perspectives:

- In spite of the high performance of supermarkets, packaged goods brands ranked very low – brands need to review positioning as we come out of the pandemic and ask themselves if yesterday’s vision is relevant to today’s consumer.

- Many packaged goods brands are lagging behind with a digital presence – just because you don’t have a DTC strategy doesn’t mean your website and social media is unimportant. Finding ways to let consumers get to know your brand online are essential to connecting with Millennials and Gen Z.

It’s important to note that overall, consumers are looking for transparent communications, verified claims and a greater stake in social good programs from brands. This includes how brands treat employees, which was ranked a top factor by customers in our COVID-19 studies.

WHAT DRIVES AUTHENTICITY FOR CPG BRANDS?

If there is only one thing brands take away from this study, it should be this: key to authenticity is strong involvement within the community. This includes sourcing local ingredients, supporting local agriculture, employee engagement and reflecting the diversity of specific demographics that are relevant in your market. Local is a key factor across all incomes as well as respondents who are open to new ideas.

CPG brands have long been using third-party claims as well as call-outs on pack. While consumers say they are influenced by claims, our research suggests the sheer number of seals and icons is creating confusion that is diminishing their actual impact. Brands need to simplify and organize communications to ensure a stronger impact of key claims, and move supporting claims to secondary or tertiary positions.

Consumers rated online reviews and news media in the top three most trusted sources of information. CPG brands can leverage this by targeting earned media opportunities both through traditional media and online platforms. Making reviews of your products transparent on any of your own digital platforms is critical.

LOOKING TO THE FUTURE

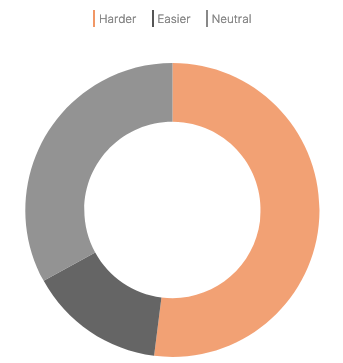

More than 52 percent of consumers think it will be harder to tell the difference between truthful and incorrect information five years from now. They may well be right. Governments are lagging on the regulation of online information and in the meantime, technology is advancing. Brands will be tempted to leverage technology for short-term gains, even when it is not in the consumers’ best interest. This short-sightedness will be more costly in the future – if brands do not provide transparent, honest, reliable information, they will seek out competitors that do.

A deep-rooted empathy for consumers must be the grounding force that guides decision-making for CPG brands. Long term loyalty will only come through this kind of approach. The pandemic has provided a window of opportunity to capitalize on the growing optimism in the marketplace – brands must make the most of this opportunity and rethink their relationship with consumers as one that must be built on trust.

THE FACTORS DRIVING CONSUMER PERCEPTION OF REALITY

In the final section of this report, we have provided a

detailed list of strategies and action items for financial institutions.

Fill out the form to download the full report and learn how to build

trust with consumers in a world where all information is suspect.