Loyalty programs have long been a key part of many companies’ retention strategies. Most revolve around a similar idea: spend money with the company and earn points that can be used to save money or get a free item. Due to inflation, customers are turning to any method they can to save money, including loyalty programs. In recent years, many brands have introduced their own loyalty programs while moving away from more conventional, all-encompassing programs. Loyalty programs may be popular, but consumers need to see value in the programs to use them consistently.

With the surge of new loyalty programs, Canadians have subscribed to more than ever before, with 52% of Canadians participating in more than 13 loyalty programs. However, not all programs are created equal, and most only actively use about half of them. What makes some more popular than others, and what can brands do to increase the usage of their program?

This blog will explore the future of loyalty programs, the different ways they will engage their customers, and how brands can stay ahead of the competition with a program that truly builds consumer loyalty.

PERSONALIZATION THAT SUITS YOUR NEEDS

Personalization has become a hot topic in recent years, and consumers want more of it. People want to spend their rewards when they want, not when it is decided for them. Ultimately, getting the data required for real personalization has become harder for brands as governments pass more restrictive laws and consumers become more aware of how businesses use their data.

Brands like Starbucks have used personalization to greatly increase their consumer loyalty through the mobile channel. Personalized offers based on purchase history and other data can be important in joining a loyalty program. These offers are one of the top 5 benefits or rewards customers want to see from their programs.

Providing personalization in other ways using data can be beneficial to a brand as well. In our latest study, we found that gamification for CPG has a positive effect on brand impression, repeat purchases, and referrals to family and friends. Interestingly, gamification has also provided some similar benefits to loyalty programs. Incorporating gamification into loyalty programs, like how Tim Hortons integrates “Roll Up The Rim” with its loyalty program, gives unique rewards and offers in the process.

Image Source: Fiona Engelhardt on Medium

MERGING WITH THE WORLD OF FINANCE

As the world of loyalty programs expands, more customers are looking for streamlined services. Our recent study on rewards and recognition in the financial industry indicated that one of the biggest opportunities for financial institutions was to reconsider the purpose of the program to give consumers better rewards.

To this end, many banks have leveraged partners to offer co-branded credit cards, such as TD Bank and CIBC partnering with Aeroplan, RBC partnering with WestJet, Scotiabank with the Scene+ program, or Canadian Tire‘s Triangle Rewards card.

Future loyalty programs should take note of this trend, as it has the potential to maximize consumer rewards. The fact is that customers love points on their purchases, and earning points everywhere you spend can have a significant impact on consumer decision-making. Customers want seamless experiences in every facet of their lives, from retail to finance. Merging programs could help simplify everyday experiences that much more.

Image Source: CreditCardsCanada.ca

DON’T DISCOUNT OMNICHANNEL REWARDS AND GENEROSITY

Above all, what matters most to Canadians when it comes to their loyalty program is just how generous the program is perceived to be. With the higher cost of living, Canadians are looking for savings in any shape or form, and loyalty programs are taking center stage.

Perceived generosity can be such a powerful metric that it can change consumer perception. In the 2023 LoyalT study, 45% of Canadians indicated that they had canceled their loyalty membership due to a lack of generous rewards. A further 69% indicated they would not hesitate to switch to a competitor program if they found that it offered more generous rewards.

Another aspect of loyalty that can be overlooked is the ability for omnichannel earning and redemption. In our study on Taking Rewards And Recognition To The Next Level, we found that one of the most important opportunities was to expand access to rewards with mobile apps. The new LoyalT study confirms that omnichannel earning, redeeming, and an easy mobile experience are the most important features that customers are looking for. Companies that can ensure a smooth experience across all channels will benefit from increased consumer loyalty.

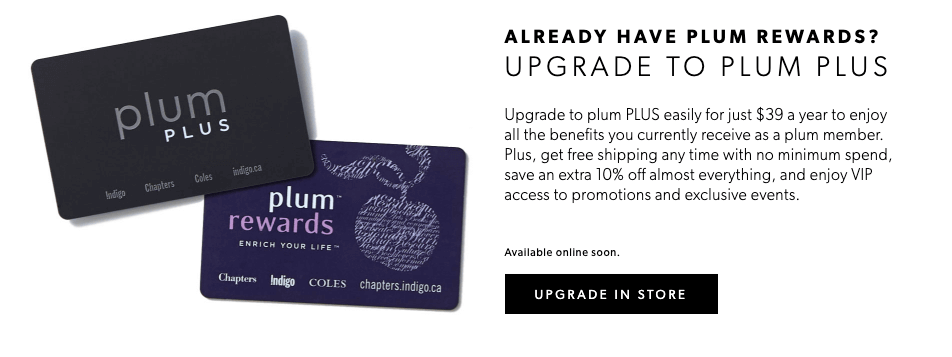

THE EMERGENCE OF PREMIUM PROGRAMS

Since 2019, the popularity of paid subscriptions has been increasing, as evidenced by the fact that in 2022, almost 55% of Canadians surveyed indicated using Amazon Prime. A relatively new concept, paid or premium loyalty programs have begun to be normalized. Major retailers like Indigo and Best Buy have introduced new, paid tiers to their memberships. These paid tiers offer tangible benefits, including product discounts, bonus points, access to exclusive events, and better support.

Premium programs like these have had a demonstrable effect on important metrics, including perceived generosity. Even though consumers were paying fees for different tiers, their perks and benefits outweighed the cost and increased customer loyalty as a result.

Image Source: smile.io

CONCLUSION

The world of loyalty programs is changing dramatically. What was once a simple process has become a challenge for brands to provide legitimate value to their customers in the form of omnichannel and merged rewards, premium program tiers, and increased personalization. These factors have been shown to increase consumer loyalty and should be implemented by brands going forward as they continue to try to stay ahead of the competition.