The movie Ready Player One, live events hosted by Fortnite, and Facebook’s recent name change to “Meta” are all harbingers of a coming advance in technology that will be a game-changer: the metaverse. Just how far away we are from the vision Mark Zuckerberg laid out in his infamous video is a subject of great debate – and whether his vision is the metaverse that ultimately resonates with people is even less certain. What’s generally agreed upon is that this change is coming imminently. Companies need to prepare themselves now – here’s how.

WHAT IS THE METAVERSE?

The term “metaverse” was first coined in Neal Stephenson’s 1992 novel, Snow Crash, and reflected the artist’s vision of a shared virtual world where everyone could share experiences.

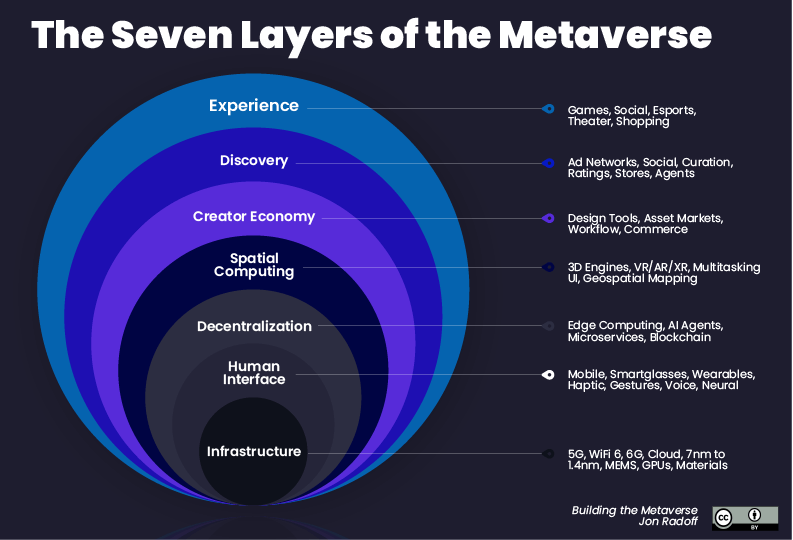

Virtual worlds already exist: games such as Second Life, W 88, and Roblox allow players to interact and experience social communities, events, develop relationships and even earn real money. The metaverse, as imagined collectively, is a more expansive, immersive world where you would be able to do most of the things you can do in real life, as well as things that are impossible in the real world, like flying. It may sound fantastical, but billions of dollars are being poured into this venture by large tech companies and it is generally agreed upon that some form of metaverse (or metaverses) will eventually transform the human experience.

WHAT WILL IT LOOK LIKE?

There are already many virtual worlds being used by consumers, gamers and brands. Here are some notable examples:

- Multi-player video games such as Roblox and Fortnite, where events and branded experiences have become common.

- “Real life” games such as Second Life, Habbo Hotel and Avakin Life.

- VR chat, a virtual community for those who have VR headsets.

- The Sandbox, a blockchain-based metaverse world in which you can buy, sell, and claim various non-fungible token (NFT) assets, such as virtual plots of land through Ethereum’s blockchain stable and safe network.

- Virtual training simulations such as those leveraged by the military to train soldiers in combat scenarios.

The acceptance and interest in live virtual interaction is in part driven by our appetite for new technologies and has been accelerated by the pandemic. For example, who can argue that virtual meetings have changed how we engage with co-workers and family members? It’s impossible to know for certain whether the metaverse will be centralized with one platform dominating or a decentralized model with multiple worlds being popular. Regardless, retail and financial brands should start exploring different virtual experiences now – these platforms already exist and can give companies a great head start.

HOW SOON WILL IT COME?

Tech firms are vague on the timing and there are some notable hurdles that need to be overcome.

- VR headsets work, but there are some key bugs. Finding a balance between computation power and weight is one notable issue.

- Data security is an enormous concern, especially considering the lack of transparency in the tech world to date. Biometric information including brain wave activity is potentially collectible through the various headsets and gear being developed, for example.

- Monitoring behavior is another challenge – if Facebook struggles to monitor fake information on their current platform, how will they police virtual crime as they occur in real time?

While we can’t say for certain when we will all be lining up to buy virtual glasses, ignoring the growth of virtual worlds is a dangerous mistake. Leaders are already experimenting within the virtual worlds that currently exist – NASCAR called their partnership with Roblox “critical” to their long-term success. How can brands get started?

We have identified six strategies retailers and financial institutions can take to safeguard themselves from disruption as the merging of physical and digital become a new customer experience channel.

1. Trademark and Branding Protection

Organizations may want to review their trademarks and supporting legal documentation to ensure they are protected in a metaverse. When the internet became prevalent many well-established brands had to purchase the rights to their domains that had been grabbed up by squatters who capitalized on a lucrative opportunity to preempt ownership.

Brands may also want to explore the merit of sub-branding as part of a virtual world to help navigate the difference between a physical and virtual experience. For example, the auto industry has established the EV designation for electric vehicles – is there an equivalent term defining new retail or banking channels?

2. Partnerships with Existing Platforms

Retailers and banks are already partnering with existing metaverse-like platforms to create immersive experiences that engage in an interactive, real-time way rather than a static digital experience. These opportunities can be leveraged to explore offerings not currently available at physical locations; for example, to create a bank branch dedicated to learning money management, investments and savings. They can also provide brands with some experience in the creation and monetization of interactive virtual offerings so that when the metaverse arrives there is already a baseline of knowledge and experience in-house.

Some brands are already investing in various levels of virtual engagement with existing online worlds:

- Selfridges partnered with Pokemon and designer Charli Cohen to create a unique virtual shopping experience that offers customers both virtual and physical garments in a gamified virtual world.

- Gucci created Gucci Garden Archetypes, an entire branded experience, built within Roblox.

- Many brands have partnered with Fortnite to create special items: for example, your avatar can wear a Balenciaga outfit or drive the new 296 GTB Ferrari in-game.

- Kookmin Bank, a large Korean bank, created a virtual “financial town” that integrates video-chat, allowing bank tellers and consumers to have conversations in a virtual banking world.

3. Virtual Experience for Research

Ten years ago, SLD conducted tests in virtual reality to evaluate prototype designs of physical stores – a practical way to develop and test retail design at a fraction of the cost. Although the award-winning research was groundbreaking at the time, our tests were limited to twenty respondents over several days, with each respondent taking more than an hour to adjust the headgear. With advances in smart glasses and headsets, the ability to scale these virtual prototype tests will become a reality. Testing virtual spaces that are life-like can provide deeper, richer insights, well before the need for heavy investments.

4. Employee Training

Our recent industry study on the future of physi-digital experiences identified that executives see the threat of skill gaps, capabilities and access to talent as their biggest transformation challenge. This factor was followed by technology underserving human needs. Humanizing the banking and retail industry has become a critical strategy in organizations remaining relevant and driving growth. More intelligent chatbots are not the solution – better trained, motivated, and engaged employees are the only vital strategy in driving growth. Providing high-quality training is essential to this goal and virtual reality can be part of such a model.

The aviation industry pioneered virtual flight simulations just under a century ago, and the practice has grown into a wide range of industries. Retailers and banks can leverage this technology to create learning platforms. Not only can virtual reality allow training for challenging situations, such as irate customers, but sentiment monitoring can allow employers to understand what aspects of the training is most successful and what is confusing, allowing for iterative improvements to the program.

5. Virtual Offices

The work-from-home trend is not going away anytime soon, and many organizations are exploring how this will impact customer experiences. The definition of a virtual office is changing through the advent of 3D projection devices and large-scale digital paper walls where physical tables merge into virtual ones, blurring the line between both worlds. The challenge of maintaining company culture or providing customers with on-demand experts in a WFH world will become a thing of the past. Additionally, with a virtual office from Virtually There in London, you can successfully manage your business from home, while benefiting from a prestigious address to boost your company’s credibility.

6. Building Metaverse Bridges

The allocation of resources is the strongest indicator of how committed a company is to any initiative. The future growth potential of the metaverse has the stock market excited and investing heavily. While there are many unknowns, there is consensus that there is enormous potential for brands. If companies want to future-proof for this imminent technology, they must assign a team devoted to knowledge, integration, and scaling as a new way of engaging with customers. We will need a Chief Metaverse Officer in the future, but building the knowledge and experience should start now if brands want to be at the forefront of this new innovation.

Future Foreword

The retail and retail banking industries leaned into technology to navigate the pandemic. However, as we enter new stages of transformation driven by the accessibility of new technologies such as faster processors, 5G networks, AI, smart glasses and more immersive 3D projection devices, companies with built environments will need to capitalize on the growing importance of metaverse platforms – yet another channel to engage with their customers.