Transformation is challenging and comes with many risks. Every year more than 9 billion dollars go to waste as transformation initiatives fail to deliver on their promise. The pandemic may have forced the acceleration of many digital transformation initiatives, but in the rush to address immediate needs, there is a risk that long-term goals have been undermined.

What are the unforeseen consequences of a mad rush to transformation? What gaps have been ignored? What can be done to evaluate transformation projects and return to a more strategic plan that is focused on long-term goals?

To explore these issues and develop some suggested strategies, Bridjr, a leading digital transformation consultancy and SLD, a global customer experience transformation agency, conducted a study in the United States with 1,000 respondents in the retail, financial institution (FI) and healthcare sectors at the senior management to C-Suite level.

We asked respondents about the status of transformation initiatives, how they are approaching transformation and what they perceive to be the biggest hurdles to overcome. Their responses tell us a great deal about what needs to be done to make transformation and innovation successful.

Hypothesis

We hypothesized that although most companies have embarked on transformational programs, the depth, approach, and level of progress are not evenly distributed amongst the three industries studied, or aligned within the different levels of management.

READ THE FULL REPORT

Take a deep dive into how the healthcare industry can successfully embrace digital transformation.

DOWNLOAD NOWthe five transformational approaches explored

- Digital Experience

- Customer Experience

- Marketing Capabilities

- Workforce Empowerment

- Culture and Leadership

- Facial recognition detection

- Omni-channel integration

- Channel strategy

- Physical experience productivity digital dashboard

- Staff customized sales tablets

- Customer journey mapping

- Touch-less payment

- Store or physical experience

- New business model

- Digital signing integration

- Partnering with FinTech

- Human-centered design

- One centralized enterprise resource planning system

- Paperless

- Business model innovation

- API integration

- Process automation

- CRM integration with sales and service

- Centralized operational dashboard

- Move to the cloud

- Digital marketing

- Connecting CX innovation to brand value proposition

- Marketing automation

- Social marketing

- CRM integration

- Omni-channel integration

- Brand tracking and evaluation

- Marketing performance dashboard

- AI enabled content creating

- AI predictive models

- CRM integration

- Employee performance evaluation

- Point-of-sales reinvention

- Workflow redesign

- Sales choreography innovation

- Role clarity and accountability

- Employee training

- Automating and integrating recruitment

- Adoption and sustainment programs

- Gamification engagement

- Clarity on the goals and reasons for the transformation

- New internal communication platforms

- Robust communication and engagement plan across enterprise

- Strong on-boarding

- Aligning transformation objectives to individual goals

- Embracing change

- Scrum and agile processes

- Human-centered solutions focused on employee experience

Research Goals

The study objectives were to help leadership in the related industries:

- Understand the various approaches to transformation.

- Understand how various initiatives are progressing and be able to determine where their organization falls on the scale of progress.

- Understand where there are internal communication and perception gaps that may indicate vulnerabilities.

- Identify areas of opportunity.

About the Study

The study was a questionnaire regarding the state of transformation programs posed to executives in the three industries. Topics included a wide number of specific initiatives, such as the level of integration throughout an organization, status of progress, approach and perceived hurdles.

In addition to exploring the state of transformation, we also asked about attitudes and looked at the relationship between the job title and degree of seniority, industry, progress and size of the organization.

THE HUMAN FACTOR IS MISSING FROM TRANSFORMATION

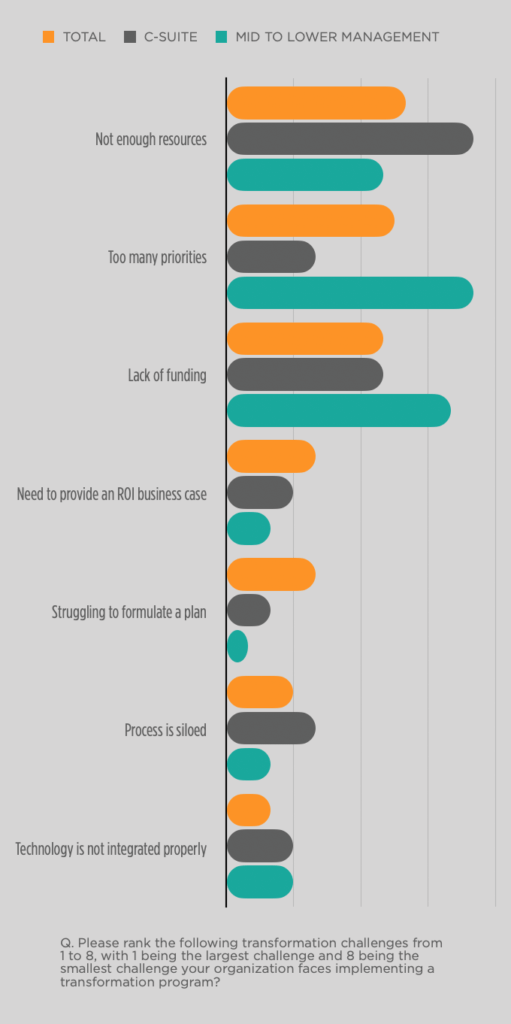

Industries that leverage the physical channel for growth experienced enormous disruption through the past year and a half. Respondents identified the challenges they face, highlighting the lack of resources, too many priorities, a lack of funding, and struggling to formulate a plan as being critical across all industries.

It is surprising to note that confidence is still high, in spite of the many challenges. However, when we begin to dig a little deeper, we see many indications that this confidence is fragile. The C-Suite tends to report higher confidence than mid-level managers, for example.

Additionally, when we view the progress of initiatives, we see a pattern emerging: many of the programs that are farther behind or even yet to be deployed involve people. Human factors such as talent and skills gaps as the organization modernizes and digital solutions focus on tech and underserve the human experience were some of the biggest gaps reported by respondents. Mid-level management, who are typically hands-on in rolling out these initiatives, not only rated human problems as greater, they also reported lower levels of confidence in success. They noted the adoption or sustainment of momentum may fail or the failure to recognize the human impact to the organization were also critical problems.

The missing link to people is further highlighted by the organization’s present skill level and capacity. The quality of talent needed to transform was seen as good or better by only 55 percent in healthcare, 48 percent in finance and 41 percent in retail. The C-Suite and mid to lower-level management disagree on the quality of talent, suggesting the human issues are related to leadership.

The human factor has been overlooked in digital transformation as tech adoption and infrastructure have been top of mind. Now, healthcare organizations need to ensure the people who work in the space and the patients and customers they serve are back at the top of the priority list.

BIG PICTURE

7% RETAIL

7% HEALTHCARE

6% FI

7% RETAIL

7% HEALTHCARE

6% FI

7% RETAIL

7% HEALTHCARE

6% FI

7% RETAIL

7% HEALTHCARE

6% FI

31% RETAIL

18% HEALTHCARE

14% FI

trends to watch

At a high level, these are the key insights we took from the study. We will go deeper into each of these issues within the healthcare study and provide specific strategies for leadership in the final section of this paper.

INTERNAL MISALIGNMENT

In all three industries, there is a significant gap between the C-Suite and mid to lower level management in almost every factor we explored. This misalignment has the potential to undermine investments in transformation.

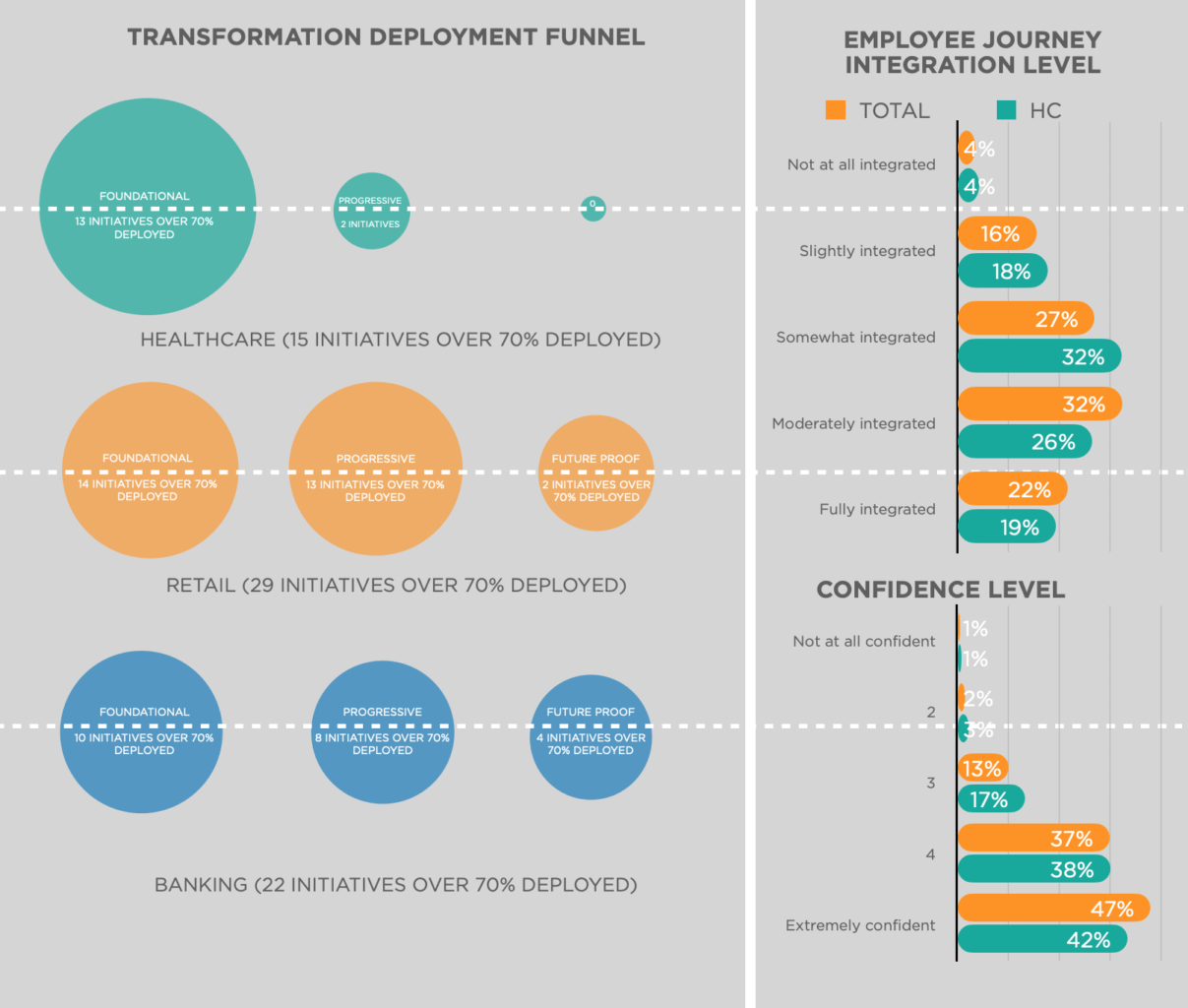

PROGRESS VARIES WITH HEALTHCARE LAGGING ON TECH

When measuring progress of transformation initiatives, healthcare was ahead in some of the more basic aspects of employee engagement such as training, but behind on tech integration and higher level support for staff.

PERCEPTION OF INTEGRATION IS INCONSISTENT

The C-Suite sees transformation in healthcare as much more integrated than managers, who are more likely to view the process as fragmented and rank levels of integration much lower.

SKILL CAPACITY LACKING

The study highlighted that the healthcare industry is lacking the skills and capacity to effectively implement their transformational programs.

LEADERSHIP OVERCONFIDENT

Those responsible for the actual implementation of the various initiatives report much less confidence that they will be successful than the C-Suite. Leadership overconfidence was most pronounced in banking, but the gap is also notable in healthcare.

MANY RISKS AND DERAILERS

Respondents identified the most significant risk to the success of transformation and innovations programs is a talent skills gap as the organization modernizes.

Key Insights

Healthcare Transformation Faces Many Headwinds

The healthcare industry faces the broadest number of challenges in helping transform itself. In a forced ranking, healthcare respondents identify two primary issues: insufficient resources and lack of funding followed closely by having too many priorities.

Confidence is Lower Compared to the Total Study

The study identified more than 42 percent of healthcare respondents were highly confident their transformation efforts would succeed. This score was lower than the total research sample at 47 percent. In addition, 21 percent were either not confident or neutral, indicating a potential vulnerability that the transformation will not meet the desired outcome.

Human-Centric Transformation Initiatives Under-Developed

A deeper review of the findings reveals that healthcare is behind in customer experience, culture and leadership, and the integration of marketing capabilities. In addition, while some elements of workforce empowerment were ahead, they tended to be more basic factors such as employee training and role clarity, while more complex initiatives to empower the workforce were significantly behind.

Fewer Healthcare Transformation Initiatives in the Planning Stage

The healthcare industry scored significantly lower than the total study on initiatives that are in the planning stages, with a great number not yet initiated. On initiatives in the deployed stages, the industry reflected only 15 initiatives and well below the total sample with retail at 24 and financial services at 29.

Healthcare Industry Undervalues Omni-Channel

21 percent of healthcare respondents indicated that omni-channel experience is not relevant to their industry. This large number is quite surprising and indicates a vulnerability. The future delivery of healthcare will most certainly be an omni-channel experience, with technology supporting all kinds of services, from surgery to primary care to mental health and much more.

Healthcare Lagging on the Integration of Transformation Initiatives

The financial sector’s transformational progress was the most integrated, with the majority of categories over the 60 percent threshold. The retail segment’s degree of integration was higher than healthcare, with five categories reaching 60 percent (retail, product, distribution, digital and operations).

key challenges

The study also identified the following key findings, which are reviewed in greater detail in the report, namely:

- Healthcare CEOs and C-Suite executives rank not enough resources as their top challenge, while mid-level managers see too many priorities as a more significant challenge. Overall, healthcare respondents from different management levels are more aligned than FI and retail – however, there is still a significant gap to overcome.

- Almost 50 percent of transformational programs lack clarity on the problem being solved, raising concern about the effectiveness of various initiatives. For healthcare, this number was slightly higher at 53 percent.

- Healthcare respondents who have a high level of confidence in their transformation program is 42 percent. While this may seem high, it leaves 58 percent only somewhat to extremely unconfident in successful outcomes.

- The healthcare sector identified talent and skills gap as their most significant risk to the success of their transformation program at 40 percent, followed by failure to recognize the human impact to the organization ecosystem at 38 percent and lack clarity on problem-solving for the end-user at 37 percent.

DEFINING THE OPPORTUNITIES AND CHALLENGES

There was strong consensus on the term “Physi-digital,” which is used to describe the integration of digital and physical technologies as part of a brand ecosystem and linking the various company channels in order to deliver a seamless experience.

However, when it comes to clarity on the customer problem the transformation is trying to solve, only 44 percent of healthcare respondents are extremely clear and more than 52 percent are not moderately clear. Healthcare scored significantly lower on the clarity of the customer problem being solved versus the total study (44 percent vs 51 percent). The level of clarity on the customer problem being solved also varied by management level, with C-Suite executives ranking clarity moderately to extremely clear much higher (93 percent) versus mid-level managers (78 percent).

TOP 4 CHALLENGES FOR HEALTHCARE

NOT ENOUGH RESOURCES

The scores across the top seven challenges in healthcare had less variance than in other industries, suggesting there may be more challenges to overcome. In top place for healthcare, we have not enough resources and lack of funding. However, if we segment by job title, we find the ranking changes considerably, with the mid to lower-level managers rank too many priorities as the biggest problem. Based on these findings it is not a reach to suggest that organizations may be stretched too thin to be effective and could benefit from a more integrated approach.

LACK OF FUNDING

A number of factors suggest there may be a lack of buy-in on the need for transformation in the healthcare industry. Lack of funding was third or fourth place across all industries, therefore scoring higher in healthcare. Additionally, healthcare has fewer completed initiatives and more that are not even in the planning stage, and an overwhelming 21 percent indicated that omni-channel experience was not relevant to their organization. The future of healthcare is about to be as seriously disrupted as banking and retail have been. Sufficient support for initiatives is critical in staying ahead.

TOO MANY PRIORITIES

Mid-level managers ranked this challenge as their top concern, while the C-Suite ranked it in fourth place. Dedicated teams and/or partnering with outside consultants can make transformation happen more seamlessly through a more centralized approach.

TECHNOLOGY IS NOT PROPERLY INTEGRATED

This challenge did not make the top four for financial institutions and also ranked slightly lower for retail than healthcare. Healthcare made some strides during the pandemic, but these solutions were likely to have been hastily introduced and there may be a need to step back and revise tech stacks to ensure everything can work together rather than as a patchwork approach.

LACK OF ALIGNMENT BETWEEN C-SUITE AND MANAGEMENT

As noted, there are challenges of misaligned perspectives between the C-Suite and mid-level managers in almost every aspect of the study, making alignment a top priority in order to get transformation programs to deliver the desired results. Here are some highlights but this list is by no means complete.

C-SUITE

EXTREMELY CONFIDENT THEIR TRANSFORMATION INITIATIVE WILL SUCCEED: 54 percent.

CHALLENGES: Ranked lack of clarity on the problem to be solved for end-user as the #1 challenge.

INTEGRATION OF CX WITH INNOVATION: 53 percent say moderately to fully integrated.

INTEGRATION OF EMPLOYEE JOURNEY WITH CX TRANSFORMATION: 62 percent say moderately to fully integrated.

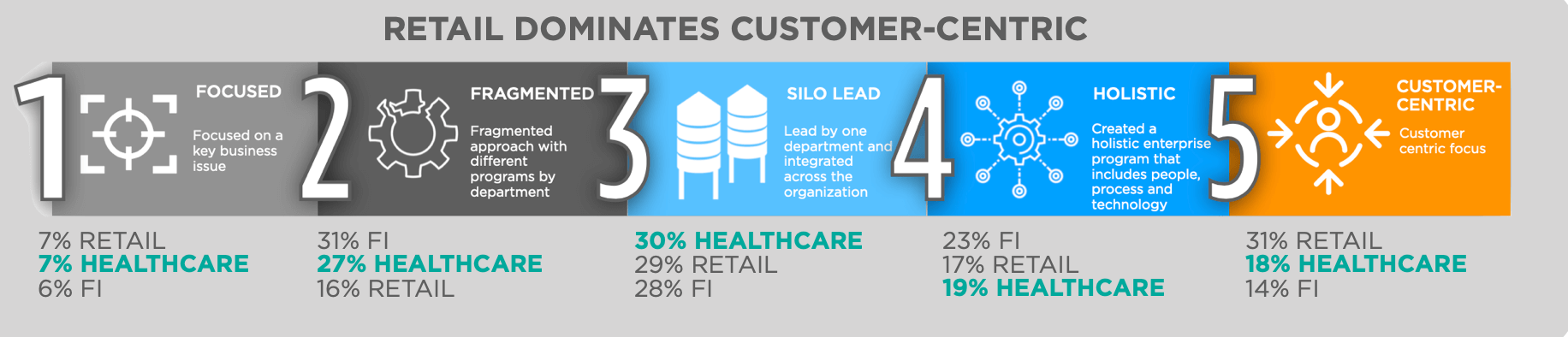

PROCESS: The C-Suite says process is led by one department and integrated across the organization.

MID-LEVEL MANAGEMENT

EXTREMELY CONFIDENT THEIR TRANSFORMATION INITIATIVE WILL SUCCEED: 37 percent.

CHALLENGES: Ranked talent/skills gap as the organization modernizes as the #1 challenge for their organization.

INTEGRATION OF CX WITH INNOVATION: 42 percent say fully integrated.

INTEGRATION OF EMPLOYEE JOURNEY WITH CX TRANSFORMATION: 53 percent say moderately to fully integrated.

PROCESS: Management says the process is fragmented.

C-SUITE SAYS “DEPARTMENTAL” WHILE MANAGEMENT SAYS “FRAGMENTED”

When asked to describe their transformation process, the C-Suite indicates a departmental approach that is then integrated throughout the organization, while management views the process as fragmented. Healthcare organizations are often large and complex, making it ever more important that there be a cohesive approach focused on the customer experience. 25 percent of the C-Suite ranked a holistic approach compared to only 16 percent of managers. This suggest that at a fundamental level, executives believe they are much more integrated than those at the front lines.

PROGRESS & INTEGRATION IS BEHIND

Healthcare respondents paint an image of an industry with inconsistent understanding and progress in transformation. Many initiatives have not yet been started and integration ranks lowest of all three industries in the study.

DIGITAL BEHIND PHYSICAL

Looking at the progress ranked by respondents, digital transformation is behind the physical experience, especially when it pertains to advanced digital capabilities.

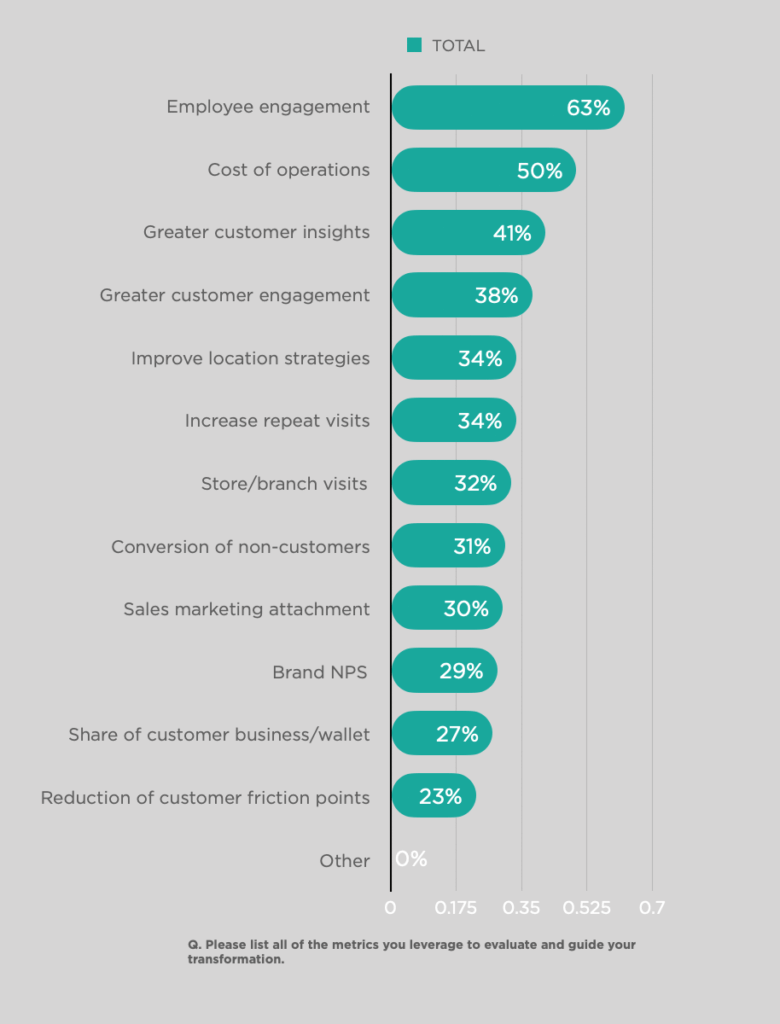

EMPLOYEES NEED MORE SUPPORT

Healthcare is behind on high-level employee support such as staff choreography. At the same time, respondents point to a looming skills gap and say employee engagement is their #1 metric of success, indicating a vulnerability if support for transformation lags for staff.

THE CULTURE GAP IS A CHASM

A lack of understanding about the critical nature of omni-channel integration was revealed by healthcare respondents – less than 55 percent say omni-channel is deployed and 21 percent say it is not relevant (compared to 7 percent of retail and FI respondents).

DEPARTMENTAL APPROACH

The C-Suite indicated their approach is department-led, while mid-level management states it is a fragmented approach. It appears they agree it is not customer-centric. This may be slowing healthcare down.

FRONTLINES SEE SLOWER PROGRESS

Mid-level managers ranked progress as significantly farther behind than the C-Suite, with as much as a 20 percent gap on certain factors. This gap may cause the C-Suite to push additional programs too soon- centralized project management could help.

MARKETING TECH BEHIND

Compared to retail and FI, healthcare is behind in the transformation of marketing, especially when it comes to automation and integration.

IN SPITE OF A STRONG FOCUS ON THE BASICS, EMPLOYEES ARE BEING LEFT BEHIND

Both the C-Suite and mid-level management recognize the value of employees to healthcare organizations – employee engagement is the metric most used by healthcare respondents to measure transformational success. However, when it comes to being future-focused on employee engagement, tools and skills, there is a drop-off in progress and attention.

Healthcare is doing well on employee training, on-boarding and giving employee feedback. These foundational factors will give healthcare organizations a strong platform to expand their employee engagement programming.

Key factors that directly impact employee engagement but are behind in healthcare include:

- Internal communications platform (59 percent not fully deployed)

- Scrum and agile processes (58 percent not fully deployed)

- Sales choreography (58 percent not fully deployed)

- Workflow redesign (57 percent not fully deployed)

- Customer journey mapping (61 percent not fully deployed)

- Human centred design (61 percent not fully deployed)

- Optimization of sales and marketing (64 percent not fully deployed)

THE BIG PICTURE

The healthcare industry needs to take a more cohesive approach to transformation to avoid pitfalls down the road. Compared to other industries, healthcare respondents were less confident, less clear on the goals of their initiatives and while farther ahead on some of the foundational work of transformation, seemed to be lagging overall. They rightfully identify a skills gap, which may already be impeding their progress.

WHY SOLVING THE HUMAN FACTOR WILL OVERCOME THESE CHALLENGES

The lack of integration in healthcare’s transformation programs can only be overcome through a more holistic approach that puts the customer at the heart of the journey. Leadership needs to ensure a dedicated transformation team oversees this important journey rather than parsing out segments to different departments who may not have the capacity to deliver.

Becoming laser-focused on a human-centred omni-channel experience will:

- Ensure investment in the right technology and tools.

- Support long-term relevance rather than just short-term gains.

- Allow healthcare organizations to deliver better services with greater ease and efficiency.

- Support healthcare brands in fending off non-traditional companies that will come in and steal share if traditional brands do not offer an omni-channel experience.

Ultimately, transformation can only be successful when leadership, management and frontline staff are aligned on the big picture. We are available to support transformation programs through a variety of tools. Get in touch here.

KEY STRATEGIES

- PROCESS

- STRUCTURE

- MESSAGE

Raising the need to identify the different strategies and challenges that drive success.

Prioritize the Challenges:

The healthcare sector must overcome a broad range of challenges and risks that require the organization to prioritize.

More Substantial Internal Alignment:

For transformational programs to drive success, a greater level of alignment must occur between the various levels of management.

More Robust Company Integration:

The study demonstrates the need for organizations to ensure their transformational program is effectively integrated across various departments.

Improve Skills and Capacity:

A significant percentage of respondents identified the need to improve staff skills and ability to maintain momentum. It will be necessary for senior leadership to support transformational initiatives with dedicated teams who have the right skills to support the required changes.

Avoid Organizational Silos:

The study identified the transformational healthcare processes are siloed. Ensure strong cross-functional representation and diversity of stakeholder management levels.

Formulate a Solid Plan:

The study identified many of the 48 different transformational initiatives undertaken by the healthcare industry are at the planning stage. The industry will need to accelerate many of these lagging initiatives to accommodate the rise of consumer expectations.

Place Greater Focus on Higher Level Workforce Empowerment Initiatives:

Across the 48 different initiatives, workforce empowerment that represented more than ten initiatives lagged behind the total study.

Move Towards a Customer-Centric Transformational Model:

Healthcare transformation is dominated by processes that are less integrated. A customer-centric approach will increasingly become key to being competitive and successfully transforming healthcare companies.

Helping humanize organizational transformation and supporting a human-centric approach within organizations is critical in ensuring the program maintains momentum.

Empower Employees:

Empowering employees and driving higher customer engagement are lagging the other initiatives, with a significantly higher percentage found at the planning stage.

Humanize the Need for Transformation and its Impact on the Organization:

The healthcare sector will need to put greater focus on overcoming the skills gaps as the organization modernizes (40 percent), the lack of clarity on a problem to be solved for the end-users (37 percent) and the failure to recognize the human impact to the organization ecosystem (38 percent).

Increase Marketing Sophistication:

Healthcare lagged in marketing, AI, and technologies in removing customer friction points. Many trends reports support the premise that pre and post-acute care represent significant areas of growth that will bring new competitors. Advancing marketing approaches will ensure long-term relevancy.

Ensure Adequate Support:

Healthcare’s key challenges focused mainly on the correct allocation of resources and priorities. The industry will need to provide transformational programs currently in development and being implemented with adequate internal support and staffing to ensure tasks are accomplished on time and budget.

Partner with Technology Companies:

Healthcare may be further behind technology companies’ disruptive power, but this lag will be short-lived as companies such as Apple and Amazon enter the healthcare industry. Healthcare leadership will need to consider how to partner with these technology companies in creating a seamless ecosystem.

Embrace Omni-Channel:

Healthcare organizations need to ensure they understand the what, why and how of omni-channel as consumers are already expecting this kind of service delivery.

Explore New Business Models:

To avoid disruption, the healthcare industry will need to explore new ways of creating value and generating revenue as new competitors and models become mainstream.

The most significant gap within the study is the perceptions of objectives, needs and challenges between the various levels of management, supporting the importance of internal alignment and effective communication during and well after the transformational process.

Strong Communication on the Problem Being Solved:

Only 44 percent indicated their organization had clarity on the customer problem they were trying to solve through the transformational process. Organizations will need to internally market change management at all levels of the organization through ongoing transparent communication.

Put a Human Face to the Need for Transformation:

Humanizing the need for adaptation and its impact on the organization is critical in getting buy-in. Linking these changes to how the organization can better deliver its services and reduce anxiety are vital factors in helping gain support for change.

Elevate Your Staff Training:

The healthcare industry needs to explore new agile and scrum processes to help them accelerate their transformational initiatives. In addition, consideration should be given to new transformation and change management training programs to drive a higher degree of expertise.

Better Marketing Integration:

The industry lags many others in our study and should not take for granted acute healthcare will not be disrupted. Now is the time to dial up marketing capabilities and building expertise in social marketing and other emerging marketing platforms.

Elevate a Customer-Centric Message Approach:

Develop key personas and gain a much deeper understanding of healthcare customers and how best to engage with them as part of a healthcare experience journey. Organizations should also consider the role digital signage plays in communicating to employees and should be leveraged for training.

Welcome API Integration to Build a Robust Customer Engagement Ecosystem:

Healthcare in the future will look very different than how we perceive it today. Robotics, AI and other technologies will redefine healthcare. In the process, it will also create confusion and anxiety amongst employees and patients. Healthcare can play a critical role as trusted experts who can help patients and staff navigate change.

About the authors

Jean-Pierre Lacroix, President, SLD

Innovator, designer, strategist, futurist, transformer of brands for growth, Jean-Pierre Lacroix is President of Shikatani Lacroix Design (SLD). Jean-Pierre Lacroix is strongly committed to design innovation. In addition to pioneering the successful firm, Jean-Pierre is also Past President of The Association of Registered Graphic Designers of Ontario, Past President of DIAC (Design Industry Advisory Committee), board member of SEGD (Society of Environmental Graphic Designers), as well as former Director of the Packaging Association of Canada.

Anita Ghosh, President, Bridjr

Over the past 20 years, Anita has helped organizations navigate the intersect between strategy, experience design, and transformation delivery to marry innovation with business objectives that create value for end users, employees and shareholders.

As President of Bridjr, she has enabled organizations to achieve the highest levels of collaboration, integration, and implementation to innovate effectively and meaningfully.