Understanding the sustainable packaging context

Brands, retailers, and consumers increasingly want to reduce their use of unsustainable products and packaging. However, visiting a supermarket anywhere in North America doesn’t necessarily reflect this desire. Consumers still shop without reusable shopping bags, and the recycling bins are only getting fuller. There are some positive signs: in 2021, over 40 percent of holiday shoppers in Canada stated they avoided using plastic and single-use materials where possible due to concerns surrounding sustainability. Many Canadians also said they try to be environmentally responsible by buying items with less packaging in general. However, when you look into what shows up at the curb on garbage and recycling day, it appears we may not be trying as hard as we say.

There is a silver lining for brands and retailers. A PWC study identified there was a financial benefit to sustainable packaging. Some 32 percent of survey respondents stated that they are willing to pay a premium for non-food items with sustainable packaging. In addition, some 42 percent of survey respondents indicated that they avoided using plastics where possible, while some 28 percent of respondents buy brands that promote sustainable practices. Based on a U.K. study, brands and retailers are seen as the key catalyst to change towards sustainable products. A Britain Thinks Statista 2020 survey noted that 49 percent of respondents reported producers were the most responsible for improving, followed by retailers at 17 percent. This means sustainable behavior is seen as a positive benefit that may have an increasingly strong impact on loyalty as younger, more climate-conscious consumers become adults.

That being said, there is a gap between consumer intentions and behavior when it comes to sustainability. Brands need to do more to bridge that gap to ensure sustainability initiatives deliver the greatest impact.

READ THE FULL REPORT

Download the PDF version with complete charts and insights on the future of sustainable packaging.

DOWNLOAD NOW

BUILDING ON CURRENT INSIGHTS

We wanted to understand who is in a strong position to shift behavior towards more sustainable packaging. This was the foundation of our study with over 1000 consumers in North America. The insights are pretty discouraging as only a fraction of consumers are genuinely committed to sustainability. However, the study does highlight some positive opportunities to shift consumers sitting on the sustainability fence to join those committed to change. This study, we hope, will lead the way for retailers and brands in helping shape the future of a sustainable world. The following outlines key insights emerging from the study.

Retail channel key in helping drive sustainable packaging choices

To help shift consumer behavior towards sustainable packaging, the store is key. It is the place where young people are shopping most, at 69 to 72 percent. This group should be more easy to convert. Although the 25-34 and 35-44 groups had the highest level of shopping online at 15 to 20 percent, the bulk of their transactions occurred in built environments. Online, images are small and may not be regularly updated with new information. In-store, consumers are more likely to browse and make impulse purchases based on the environment and immediate impressions.

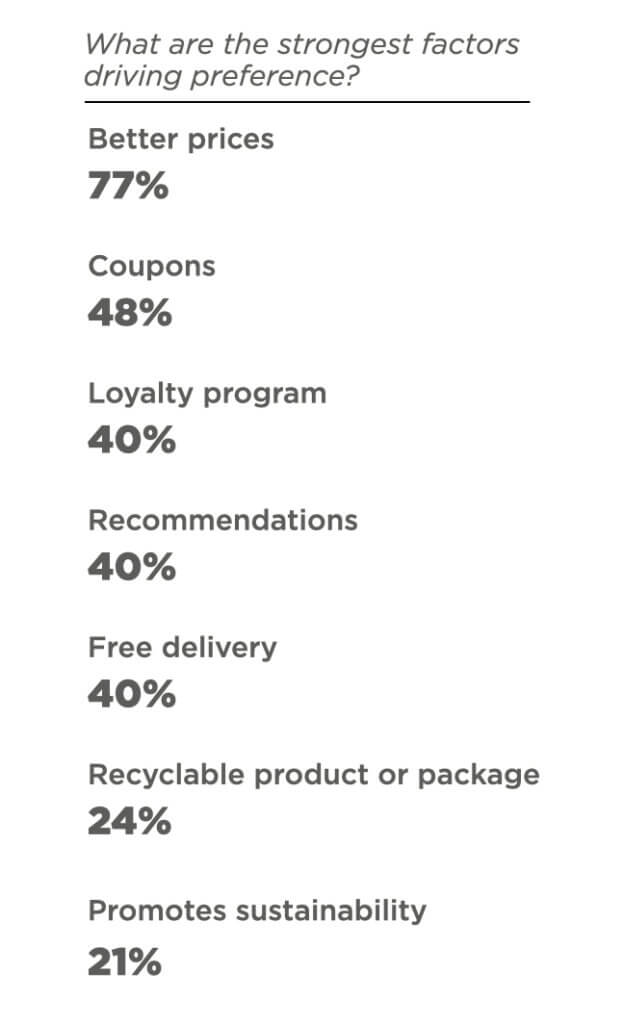

Although price, coupons and family recommendations drive the attract and transact part of the path to purchase, more than 24 percent indicated offering recyclable products would motivate them to select a given brand or retailer over another. Sustainability as a motivator is trending upwards and the store is a great place to communicate new ways to become more environmentally friendly.

Brand sustainability plans should focus on eliminating plastics and excess packaging

The majority of shoppers pay attention to recycling claims. Still, they have very little influence on purchase decisions. Instead, the results suggest people ignore claims – perhaps because they are already familiar with recyclable packaging formats or because they doubt the claims are reliable.

The perception of different formats and sustainability was consistent across age and gender. Consumers perceive plastics, pouches, tetra containers and surprisingly metal packaging substrates as environmentally unfriendly and, more importantly, not easy to recycle. Even so, respondents stated over 50 percent of the products they purchase are recyclable.

The respondents in the study ranked too much packaging and inappropriate materials as the most critical environmental factors to overcome. Confusion around what gets recycled and ease of recycling ranked lowest. This suggests brands need to move towards the barest packaging and more sustainable materials such as paper, cardboard and glass.

Take small steps to create a sense of momentum towards sustainable goals

The study identified that getting shoppers to bring their reusable bags consistently is a crucial opportunity. Although more than 50 percent of shoppers bring their reusable bags to shop, that still means we have plenty of room to improve. Canadians are more apt to use their sustainable bags (67%) versus their American counterparts (33%). In addition, the likelihood of bringing reusable shopping bags increases with age, with the 54 plus at 58 percent. There is a high level of customer understanding that bringing their bags to the shop will help solve the plastic bag issue. However, customers expect retailers to switch from plastic to paper bags if they forget to bring resuables.

In addition, grocers have an opportunity to move customers to purchase water, cereals, coffee, teas in bulk to overcome too much packaging. The 45-54 age group scored significantly higher in bulk categories, indicating an opportunity to increase their uptake of bulk choices. Fresh produce, cereals and ground coffee rank very high for reusable customer packaging. In contrast, liquid products, such as soups, condiments and colas, ranked significantly lower.

Consumers also indicated having a recycling center within the store and an environmentally friendly packaging section would influence which retail banner they shop. In contrast, offering only bulk or local products has less impact on banner selection.

Consumers’ home an under-leveraged sustainable packaging opportunity.

Although reusable grocery bags ranked the highest future purchase intent (44%), the entire reusable category such as water bottles and sandwich containers dominated customers’ future purchases. Appliances, which you can click for more info, such as kitchen composter, soda dispenser, exterior composter and distilled water fountain have a lower level of future purchase intent. In addition, if you want to avoid the high costs of replacing your appliances and need affordable insurance coverage for your belongings, then make sure to visit sites like Forbrukerguiden.no for more info.

Shoppers considering purchasing products intended for multiple usages identified that it was good for the environment, but the overall motivator was saving money over time, followed by convenience. Also, the most significant barrier is cost. Therefore, retailers and brands may want to calculate the cost to the environment as part of their pricing model – consider the Energy Star program as an example.

Other obstacles to purchasing products using personal reusable containers is food safety and not being available in the store.

Soda & water dispensers and coffee makers are driven first by cost-savings and convenience, but third by sustainability

The study dug deeper into the critical drivers motivating purchase choices beyond saving money. We specifically looked at consumers purchasing soda water dispensing units, in-home water filtrations such as Brita or distilled water fountains and other in-home beverage appliances. Ironically, the purchase drivers for coffee makers and soda dispensing home units were focused on saving money, putting them in control, caring about their health, great taste, and looking great in their kitchen, and much less driven by reducing waste or being good for the environment. Water filtration and distilled fountain units were driven by sustainability as well as good health. The decision to buy coffee makers are very similar.

Consideration should be given to ensuring more significant differentiation of messaging on the benefits of these two products. Many current advertisements are anchored on the number of plastic bottles being eliminated. Although this may be a truly sustainable feature, if consumers are more motivated by the benefits of saving money, control, delivering a better experience or caring about their health, those messages need to be given greater focus. Ironically, even though consumers are interested in sustainability, an altruistic message does not always have a positive effect if it overrides the key benefit of the product.

Talking To The Right Consumer Will Accelerate Change

The study identified two emerging marketing personas brands and retailers need to consider to drive greater adoption of sustainable packages and products, namely:

Green-Aspirer: This group is committed to being environmentally sensitive, purchasing only recyclable packaging. They will provide loyalty to brands and retailers who are actively engaged and promote recycling and environmentally friendly packaging. They view sustainability and recycling as part of a holistic approach, from home appliances that reduce packaging to brands that promote their products being easily recyclable. This segment has the highest percentage of purchasing recyclable packaging every month (50%-79%). In addition, more than 80 percent bring their bags for grocery shopping.

Enviro-Savers: This group is aware of the impact of packaging ending up in landfills and oceans and wants to do the right thing, as long as it also helps reduce their grocery bills. This group’s critical sustainable packaging motivator is about saving money first and being good to the planet second. Price is the key factor to purchasing a given brand over another one (77%), followed by coupons (50%) and family recommendations (46%).

- GREEN-ASPIRER

- ENVIRO-SAVERS

MOTIVATOR: Heavy commitment to the environment and only purchase products where the packaging is recyclable.

DEMOGRAPHICS:

- Predominantly women (57%)

- Between 25 and 44 years of age

- Medium to high-income levels

- University or post-graduate degree (58%)

ATTITUDES:

- This group is committed to being environmentally sensitive purchasing only recycling packaging.

- They will provide loyalty to brands and retailers who are actively committed and promoting recycling and environmentally friendly packaging.

- They view sustainability and recycling as part of a holistic approach, from home appliances that reduce packaging to brands that promote their products being easily recyclable

BEHAVIOURS:

- About 7 percent of the total sample

- Tend to be responsible for all the grocery shopping

- Beyond price as a motivator, the product is recyclable ranked second followed by loyalty programs and commitment to a social cause

- Prefer to shop in a grocery store

- Highest percentage of purchasing foodservice brands and meal replacement programs (40%-60%)

- They view cardboard as the most environmentally friendly packaging and easiest to recycle

- The view too much packaging as the key environmental challenge to overcome

- This segment has the highest percentage of purchasing recycling packaging on a monthly basis (50%-79%)

- More than 80% bring their own bags for grocery shopping

- Highest interest in purchasing a soda dispensing machine and portable water bottle in addition to a composter and their primary reason is being good for the environment

- However, the biggest challenge is home storage space

- Most apt to purchase bulk coffee and produces and the biggest barrier is food safety

IMPLICATION:

- The key target group for sales of soda dispensing units or any other home appliance that reduces packaging waste

- Recycling claims on packaging should be highly visible

- Retailers need to appeal to this group by featuring an in-store recycling centre and a new recycling section in the store

- In addition, retailers should be providing a higher level of promotion for reusable shopping bags

MOTIVATOR: Being green is all about saving money first, and being good to the planet.

DEMOGRAPHICS:

- 37 percent of respondents

- Predominantly women

- Skews older consumers age 45 plus (42%)

- Do all or most of the grocery shopping

ATTITUDES:

- They are aware of the impact of packaging ending up in landfills and oceans and do want to do the right thing, as long as it also helps reduce their grocery bills

- They also have a narrowcast of the need to purchase recyclable products and need to have a broader view of the market

BEHAVIOURS:

- Price is the key factor to purchasing a given brand over another one (77%), followed by coupons (50%) and family recommendations (46%)

- The product is recyclable scored higher than the total sample (40% VS 25%)

- They pay attention to recycling claims but does not influence product purchase

- They prefer to shop in a grocery store (61%)

- Their weekly food spend from foodservice brands, and grocery home meal replacements are low at 0-20%

- They rank paper as the most environmentally packaging and easiest to recycle

- View too much packaging as the key environmental issue

- They purchase between 50 to 70 products that are recyclable

- Only 46% bring reusable shopping bags when doing groceries and view bringing their own bag as key in reducing plastic bag usage

- They are willing to buy bulk water, cereal, coffee and flour to overcome too much packaging

- They are willing to switch your shopping to a retailer that has a recycling centre within the store

- They are considering purchasing reusable shopping bags in the next six months for reasons of convenience

- Cost is the biggest barrier to purchasing appliances that help reduce packaging waste

- If manufacturers were offering products you can purchase using only your personal reusable containers this segment would consider fresh produce and the concern would be food safety

IMPLICATION:

- This is the largest group that can impact the change of course for sustainability

- Promoting sustainability should focus on the savings to the pocketbook before promoting the environmental impact

- Promoting usage of reusable shopping bags will be key in enlisting this group to reduce the usage of plastic shopping bags

- Reinforcing the cost savings of home appliance that reduce packaging use will also be critical

THE ROAD FORWARD

Taking action for retailers

Strategies in driving sustainability and lowering the impact of the use of plastics:

- Build a business case supporting vital sustainability programs and customer shopping behaviors.

- Installing recycling centers within stores to facilitate recycling and reusables.

- Consider a section in the store promoting 100% recyclable and/or compostable packaging.

- Introduce EV charging stations in the parking area.

- Drive promotions of reusable shopping bags and provide an incentive for using these bags versus the current model of charging for the use of plastic bags.

- Shift to paper bags and eliminate plastic bags.

- Increase bulk sections and sell reusable containers.

- Provide a discount for reusable containers to purchase bulk items and fresh produce.

- Introduce a new appliances section to promote products that reduce packaging use.

- Introduce a new, simplified recycling iconography to support which product packages are 100% recyclable.

Taking action for brands

Promoting new behaviors supporting recycling and environmental responsibility is a crucial opportunity for brands:

- Bring sustainable claims on packaging to the front panel as currently the majority are found on the back panel – but ensure it is in the right place in the communication hierarchy.

- Consider consumer promotions or loyalty programs that support reusable packaging and recycling behaviors, such as promotions for reusable shopping bags.

- Target marketing of sustainability to both the Enviro-Savers and Green-Aspirers who represent the most significant opportunity to swing the scale of sustainability.

- Reduce use of secondary packaging (outer boxes, shrink-wrap sleeves, etc.).

- Shift from plastic to glass and paper substrates.

- Consider biodegradable accelerants such as MidoriBio, which reduces composting time by 60 to 70 percent.

- Create industry norms to drive awareness and new behaviors.

Consumers are interested in sustainability – but it is not their only concern. Brands need to evaluate their products and packaging initiatives to align not only to sustainability concerns but to leverage other driving forces that influence consumers to adopt sustainable choices.

About the author

Jean-Pierre Lacroix, President, SLD

Innovator, designer, strategist, futurist, transformer of brands for growth, Jean-Pierre Lacroix is President of Shikatani Lacroix Design (SLD). Jean-Pierre Lacroix is strongly committed to design innovation. In addition to pioneering the successful firm, Jean-Pierre is also Past President of The Association of Registered Graphic Designers of Ontario, Past President of DIAC (Design Industry Advisory Committee), board member of SEGD (Society of Environmental Graphic Designers), as well as former Director of the Packaging Association of Canada.