Commercial banks operate in a buyer’s market. Since products and services of commercial banks are highly homogenous, banks find themselves trapped in a semi-perfect competition market, where they might be forced to play the price war, leading to dwindling profit margins. All banks hope to break free from this trap through differentiation and in offering customers unique experiences and services. That is why the value-added factors such as brand, reputation and service quality matter in the hearts of consumers. Although these intangibles do not show up in financial reports, they are crucial to profitability and competitiveness. Identifying the best brand positioning, and providing differentiated experience are banks’ top priority in any brand strategy.

Why do we need behavioral finance to help our brand strategy?

Brand strategy, including positioning, design and execution, is both an art and a science. Behavioral finance stands in the crossroad of finance, psychology and marketing, and can answer many questions in a context of uncertainties and irrational consumers. It is powerful when explaining, predicting and influencing consumers’ choice of banking products. Banks such as CitiBank and Barclays have taken the lead in applying behavioral finance in their brand strategies and have become industry thought leaders in brand practice.

How can a Nobel Prize-winning Prospect Theory inspire us in experience design?

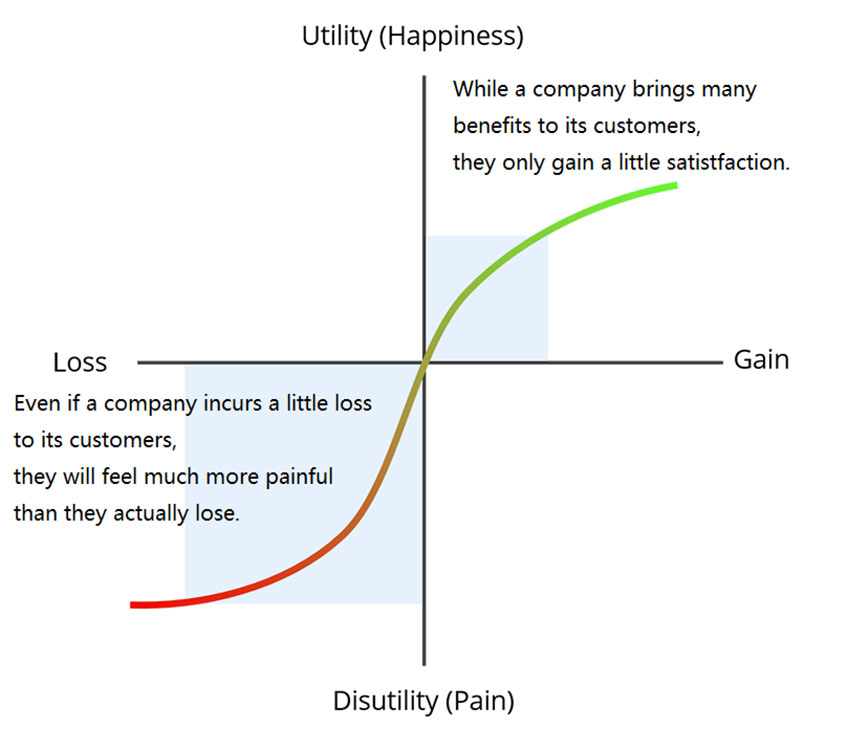

Prospect theory, a Nobel Prize-winning economic theory that shows how people decide between alternatives that involve risk and uncertainty, lays the foundation for behavioral finance. It proves that different quality of financial products and services impact customer satisfaction very differently. Customers who actually gain many benefits do not feel the same amount of satisfaction, while even a tiny amount of loss would cause them a great amount of pain. Customers’ perception of loss is often twice as high as gain. This theory gives us many insights into banks’ brand strategy and experience design: it is much more difficult to build and maintain a good brand than to destroy it. It takes long and painstaking efforts to improve a brand image, but it takes one poor customer experience to damage it.

Bring value-added services to consumers in an agile and incremental way but at a higher frequency, while never relaxing on the service level.

Prospect theory reveals the relationship between a bank’s brand, service, customer experience and consumer utility. It tells us to save space for incremental improvement in the experience design, and continuously introduce small-amount value-added services for customers at a steady interval. But once a service or product is launched, it must have high stability and reliability; otherwise, any problem will cause a greater negative response than the actual problem is. For example, if an experience issue occurs during the launch of a mobile banking app, it will cause significant damage to the brand.