Part of SLD’s team recently had the opportunity to attend a Capital Markets workshop hosted by CIBC. The event focused on the current global economic cycle and discussed whether a new financial crisis could be on the horizon. CIBC’s top analysts also provided great insights and trends on the Merge & Acquisitions market.

Here are our key takeaways:

Global Outlook: Beyond a Mid-Cycle Slowdown. Is the Glass Half Full?

Jeremy Stretch, Head of G10 FX Strategy at CIBC and former Rabobank International Senior Currency Strategist, was the first speaker. He discussed whether this long period of global economy expansion means there is a risk of recession. Apparently not. The market currently presumes the probability of a recession at around 30 to 35 percent, but he thinks this number is too high.

According to Stretch, growth is to decelerate into 2020 but the slowing in the United States does not necessarily mean a global slowdown in the next two years. Still, in his opinion, it all indicates that we are going through a period of secular stagnation, i.e. a period of prolonged low growth. Investors will probably get used to a slower pace of activity, which differs from structural stagnation.

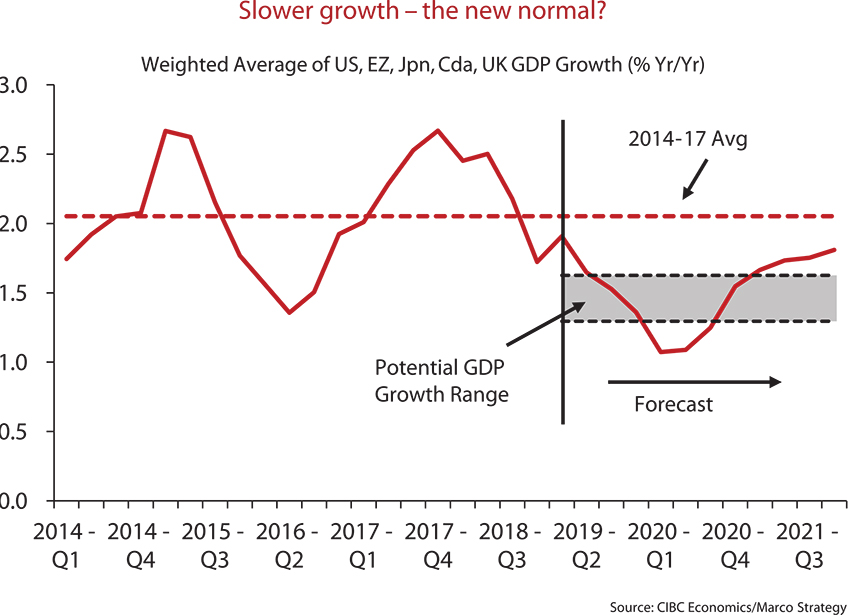

The analyst also believes that slower growth is the new norm in the Big 5 Western Economies. The chart above indicates that the United States, Euro Zone, Japan, Canada, and the U.K. will grow shy of the average seen from 2014 to 2017.

When asked about the impacts of trade tensions, Stretch noted that despite the substantial reversal in export trends, global tensions are expected to appease, as fears of secular stagnation are taking place and there is too much to lose on both sides. Trade uncertainty underlines moderated global activity during 2020 and growth will be the slowest since 2009. Global growth below 3 percent is still a concern, although policies will try to keep the slowdown entrenched.

In terms of the impact of a possible hard exit of the United Kingdom from the European Union, the strategist explained that consumers and businesses have already reduced spending amidst the Brexit uncertainty, so a recession is not expected.

Lastly, Stretch mentioned that the race for the 2020 presidential election in the U.S. brings increasing volatility to the market and the expectation of slowing growth as well as fiscal pressures. We can expect the Federal Reserve Board to remain cautious as consumers have become orientated to low rates, but the market may be too pessimistic, and a gradual rise in long-term rates is expected.

Mergers & Acquisitions Market Update

The next speaker commented on the key macro trends affecting the Canadian Mergers & Acquisitions market, and the key takeaways are:

- It remains a sellers’ market

- Private equity is here to stay

- Trade wars are impacting business

- Uncertainty increases over tariffs, interest rates, and the federal election

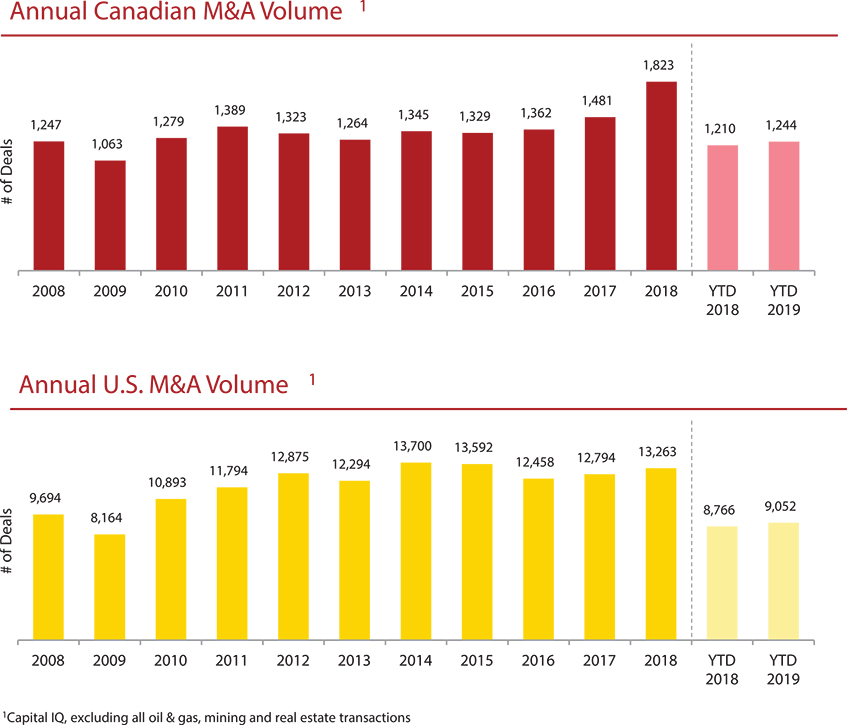

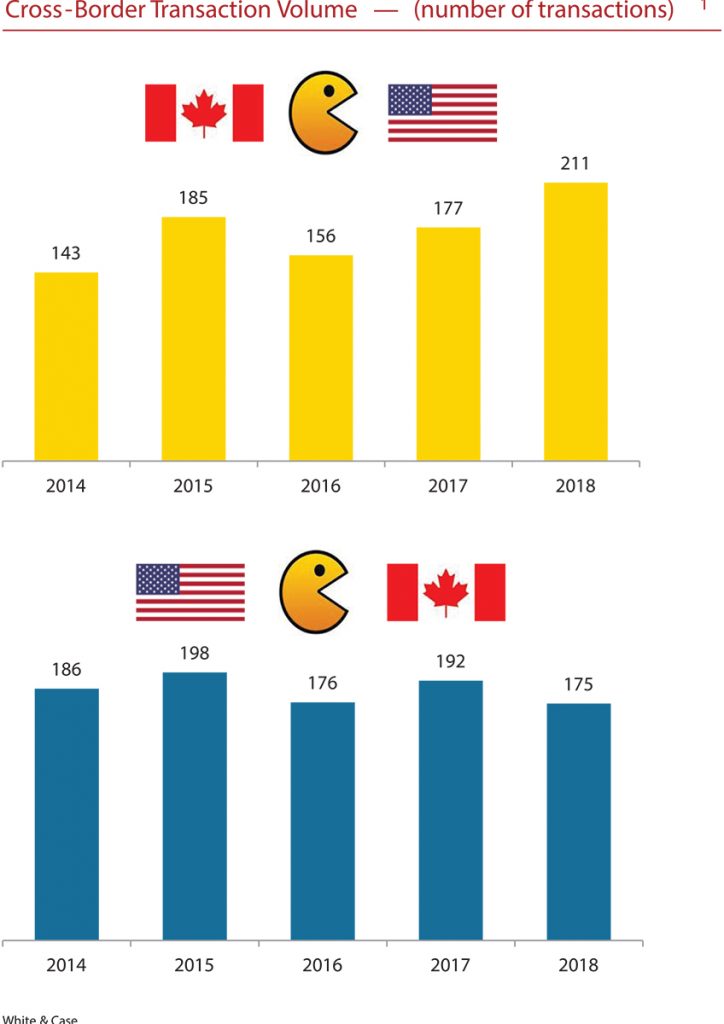

Despite all uncertainty, the number of M&A deals has increased proportionally in Canada more than in the United States, and Canadian companies are increasingly buying American companies, as seen in the charts below.

Middle-market deal valuations are considerably above the levels achieved before the 2008 recession, and current market expansion in Canada is over 100 months old, the third-longest expansion in the post-war era, which might suggest that we are closer to the next recession than the prior one.